Chart of the Day 7/7/25: Will Trump Threat Break the BRICS?

President Trump is coming for the “BRICS.” Or more accurately, countries that align with the policies of the BRICS nations.

The acronym stands for Brazil, Russia, India, China, and South Africa. Representatives for those countries – and other Middle East and emerging market nations like Saudi Arabia, Egypt, and Indonesia – are currently meeting in Brazil. They slammed Trump’s policies and warned against “unjustified unilateral protectionist measures.” Trump then responded by saying he’d slap an additional 10% tariff on nations that ally with the BRICs.

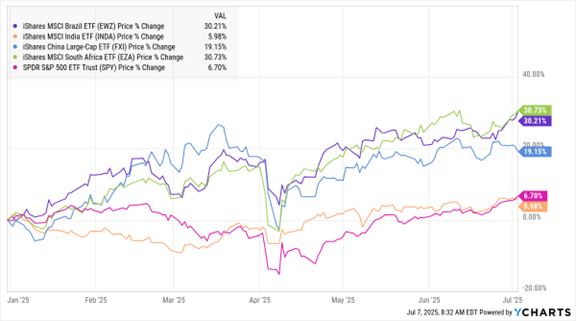

So far this year, though, investors have profited handsomely from targeting BRICS markets. Just look at the MoneyShow Chart of the Day. It shows the year-to-date performance of the iShares China Large-Cap ETF (FXI), iShares MSCI Brazil ETF (EWZ), iShares MSCI South Africa ETF (EZA), and iShares MSCI India ETF (INDA), as well as the SPDR S&P 500 ETF Trust (SPY). As a reminder, trading in US-listed, Russia-focused ETFs was halted due to sanctions tied to the Ukraine war.

EWZ, INDA, FXI, EZA, SPY (YTD % Change)

Data by YCharts

You can see that even the worst-performing ETF – INDA – is up 5.9% YTD, almost even with the SPY. Meanwhile, FXI is up more than 19% while EWZ and EZA are both up more than 30%. Funds that track foreign markets are benefitting from a falling US dollar, expectations for stronger growth overseas, and relatively strong commodities markets.

Only time will tell if Trump’s latest threat will break the BRICS markets. But so far in 2025, they’ve given investors a solid portfolio foundation.

Finally, if you want to get more articles and chart analysis from MoneyShow, subscribe to our Top Pros’ Top Picks newsletter here.