TransDigm Group's Q3 2025 Earnings: What to Expect

/Transdigm%20Group%20Incorporated%20logo%20and%20products-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $88.4 billion, TransDigm Group Incorporated (TDG) is a leading global designer, producer, and supplier of highly engineered aircraft components, serving nearly all commercial and military aircraft in operation today. Through its specialized segments: Power & Control; Airframe; and Non-aviation, the company delivers mission-critical technologies to aerospace, defense, and select industrial markets worldwide.

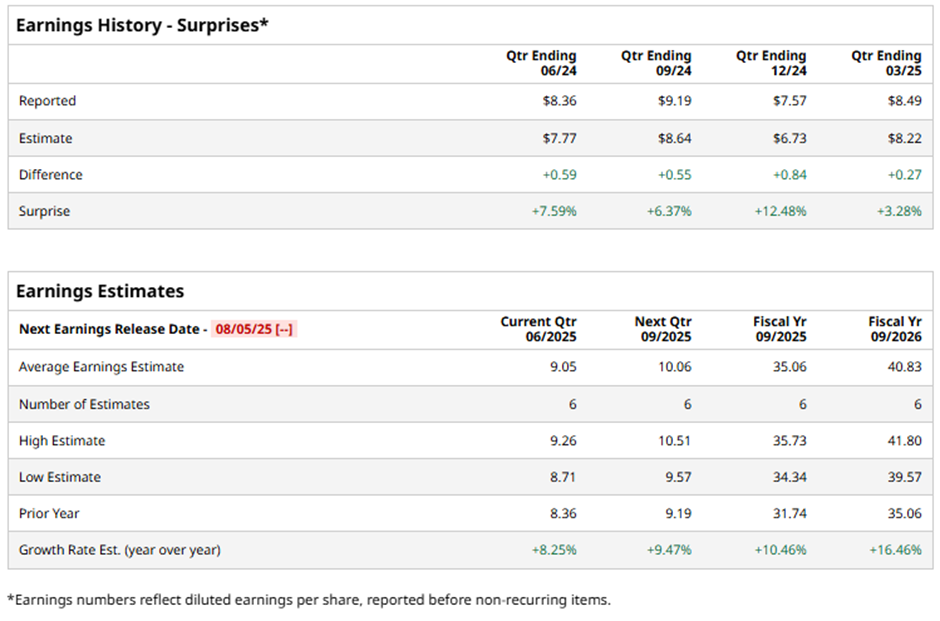

The Cleveland, Ohio-based company is expected to release its fiscal Q3 2025 earnings results on Tuesday, Aug. 5. Ahead of this event, analysts project TDG to report an EPS of $9.05, an 8.3% growth from $8.36 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in the last four quarters.

For fiscal 2025, analysts forecast TransDigm to report EPS of $35.06, up 10.5% from $31.74 in fiscal 2024. Moreover, EPS is expected to grow 16.5% year-over-year to $40.83 in fiscal 2026.

Over the past 52 weeks, TDG stock has risen around 23%, outperforming the broader S&P 500 Index's ($SPX) 10.5% return and the Industrial Select Sector SPDR Fund's (XLI) 19% gain over the same period.

Despite beating Q2 2025 adjusted EPS expectations with $9.11, TransDigm shares fell 5.5% on May 6, likely due to its revenue of $2.2 billion, falling short of the consensus. Investors may have also reacted to the steep drop in cash and cash equivalents, which declined to $2.4 billion. Nevertheless, the reaffirmed full-year guidance of $8.8 billion - around $9 billion in sales and EPS of $35.51 - $37.43.

Analysts' consensus view on TransDigm stock is bullish, with an overall "Strong Buy" rating. Among 21 analysts covering the stock, 16 suggest a "Strong Buy," one gives a "Moderate Buy," and four provide a "Hold" rating. As of writing, the stock is trading below the average analyst price target of $1,620.81.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.