Stock Market: Earnings Are Still Driving The Stock Futures

Today's economic calendar sees very few market-mover releases, which provide investors with a small amount of breathing room after a week of policy changes in monetary policy and mixed trade directions. But don't confuse this breathing room with stability. While there's no significant releases scheduled for today, market watchers are using this small moment of opportunity for a reset heading into the more significant indicator releases tomorrow.

We now turn to the fresh data set this Wednesday that can re-set expectations for levels of interest rates, inflation orientation, and industrial activity. Emerging at a time when macroeconomic tensions are still mounting—from labour markets imbalances to shifting trends of world trade flows—every data point matters.

We recommend waiting until tomorrow's releases, when they may more clearly show whether the U.S. economy is on a path to soft landing—or continuing into contraction. Markets will react quickly, with rate-sensitive sectors, currency markets, and bond yields all set to react.

Stock Prices

Economic Factors And Shift in Geopolitics

Markets responded negatively to fresh presidential threats of possible new chip import tariffs—a move which caught chip stocks off guard and a concern about rising trade tension. Meanwhile, weak manufacturing and labour hold near-term growth prospects in check, which contributes to speculation about a more tentative Fed approach towards rate easing. Sentiment for investors remains poor with heightened macro uncertainty.

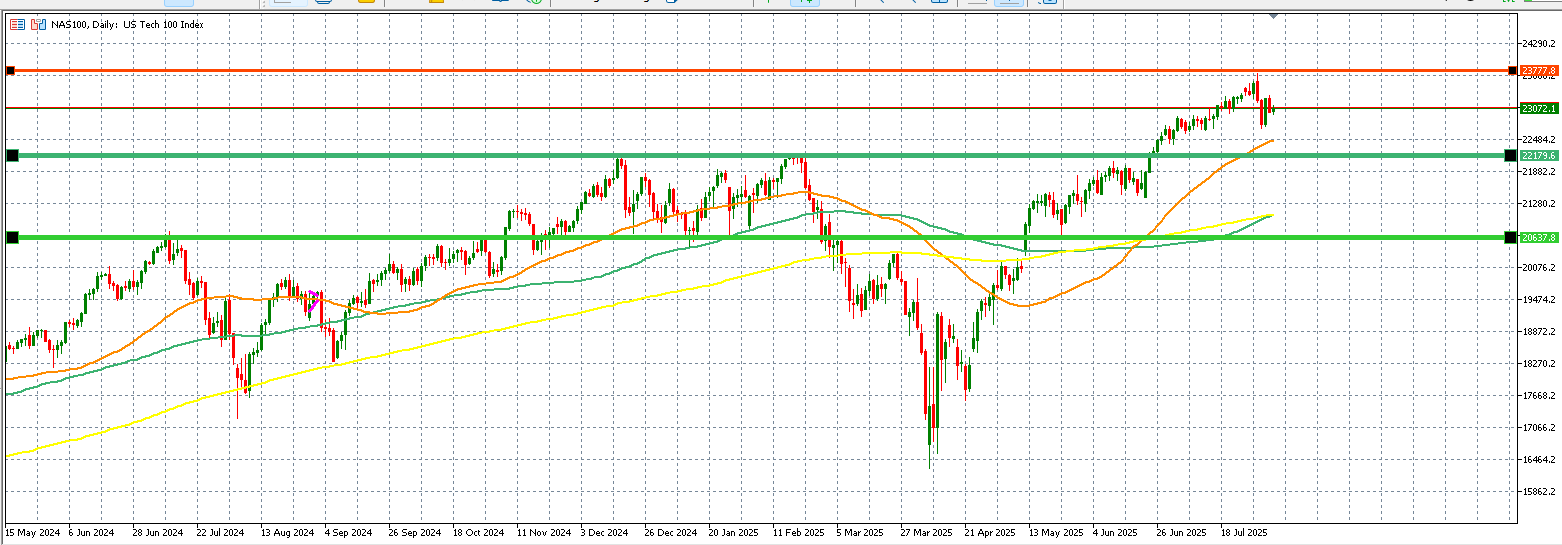

The below MT5 chart chart shows the overall trend for the Nasdaq 100 which is a tech heavy index

Chart by AvaTrade

Earnings Recap – August 5, 2025

- Advanced Micro Devices Inc. (AMD)

AMD posted second-quarter revenue of $7.7 billion, surpassing expectations driven by strength in its data center segment, which rose 14% year-over-year to $3.2 billion. Despite meeting EPS expectations at $0.48, the stock faced modest pressure as margins tightened due to elevated AI infrastructure investment. While the headline beat was encouraging, investor enthusiasm had already been priced in, prompting a muted post-report reaction.

- Caterpillar Inc. (CAT)

Caterpillar missed estimates as macro headwinds and tariff-related costs weighed on international demand, particularly in Asia. Though North American infrastructure projects provided support, order intake showed signs of deceleration. Markets responded cautiously, reflecting broader concerns about cyclicality and slowing global equipment sales.

- Amgen Inc. (AMGN)

Amgen delivered steady results with flat revenue growth, supported by new product uptake in oncology and inflammation. Despite ongoing biosimilar pressures, the company reaffirmed full-year guidance. Investors viewed the report as stable, with slight gains on confidence in its late-stage pipeline development and portfolio execution.

- Arista Networks Inc. (ANET)

While detailed reporting was limited, ANET’s consensus estimates pointed to strength in cloud and enterprise networking demand. With anticipated EPS near $0.65, investors are likely weighing expansion in AI infrastructure demand against margin sustainability in a competitive environment.

- Eaton Corporation PLC (ETN)

Eaton’s results were expected to be strong, with an EPS estimate of approximately $2.93. Market anticipation centered on backlog conversion in electrification and aerospace segments. Investor focus remained on forward guidance, as momentum in industrial demand remains a key valuation anchor.

- Fidelity National Information Services Inc. (FIS)

FIS disappointed on earnings, weighed down by delayed client rollouts in banking tech solutions. However, the merchant solutions division showed resilience, offering a partial offset. The stock came under pressure post-earnings as investors reassessed the pace of its recovery and margin trajectory.

Earnings Preview – August 6, 2025

- McDonald’s Corporation (MCD)

McDonald’s is projected to deliver Q2 EPS of $3.14 with revenue near $6.7 billion, driven by menu innovation and digital expansion. Investors will be focused on same-store sales growth, expected around 2.6%, and whether recent promotions have succeeded in countering inflation-driven traffic softness. Commentary on international performance and loyalty app adoption will be key catalysts for market reaction.

- The Walt Disney Company (DIS)

Disney’s earnings will be dissected for updates on streaming profitability, theme park margins, and developments around ESPN’s strategic future. Investors are also watching closely for cost-cutting execution and any clarity on studio output disruptions. Sentiment hinges on improving fundamentals in its direct-to-consumer segment.

- Uber Technologies Inc. (UBER)

Uber's Q2 results are expected to highlight ride-hailing growth and margin expansion in delivery. Markets will scrutinise whether demand trends hold amid slowing consumer discretionary spending. Updates on Uber One subscription growth and mobility platform integrations will influence forward guidance expectations.

- Shopify Inc. (SHOP)

All eyes are on Shopify’s ability to sustain e-commerce momentum, with particular focus on subscription solutions and merchant services growth. Investor attention will also be on profitability metrics and whether elevated customer acquisition costs are being contained.

- AppLovin Corporation (APP)

AppLovin’s focus will be on mobile ad platform monetisation, especially on the demand-side network. With digital ad budgets still under scrutiny, investors will look for stable CPM growth and expanded partnerships to justify valuation multiples.

- Airbnb Inc. (ABNB)

Airbnb’s results will be dissected for insights into summer travel trends, booking strength, and host growth. Regulatory risks in major markets and updates on platform safety reforms will also factor into investor sentiment. Forward bookings and occupancy rates will be key indicators of momentum.

- Coca-Cola Euro-pacific Partners PLC (CCEP)

Currency headwinds and pricing dynamics across Europe will be in focus. Volume growth and regional sales composition will help determine if the company can maintain margin stability in an uncertain macro environment. Investor focus remains on cost discipline and product mix.

- Joby Aviation Inc. (JOBY)

As a pre-revenue company, investor interest will be on progress toward FAA certification and production milestones for its electric aircraft. Commentary on partnerships, commercial launch timelines, and government engagement will shape valuation sentiment.

- New York Times Company (NYT)

NYT’s report will be evaluated for digital subscriber growth, advertising recovery, and cost containment. Investors are particularly attentive to churn trends and the monetisation pace of newer content verticals. The outlook for Q3 media spend will likely steer market reaction.

- Blackstone Secured Lending Fund (BXSL)

BXSL’s loan portfolio will be reviewed for non-performing asset trends amid tightening credit. Interest rate sensitivity and updates on new originations will drive investor interest. Market focus will be on net investment income and commentary on portfolio health.

- Wix.com Ltd. (WIX)

Wix will be watched for updates on user growth, ARPU trends, and churn management. With competition heating up in the website-builder space, innovation in AI integration and customer retention strategies will be key for sustaining forward growth.