Chart of the Day - October Live Cattle

The information and opinions expressed below are based on my analysis of price behavior and chart activity

Thursday, August 7, 2025

October Live Cattle

If you like this article and would like to receive more information on the commodity markets from Walsh Trading, please use the link to join our email list -Click here

Every morning, at about 8 AM CST, I post a short video highlighting where I see opportunities in the futures markets. You can view my most recent video here

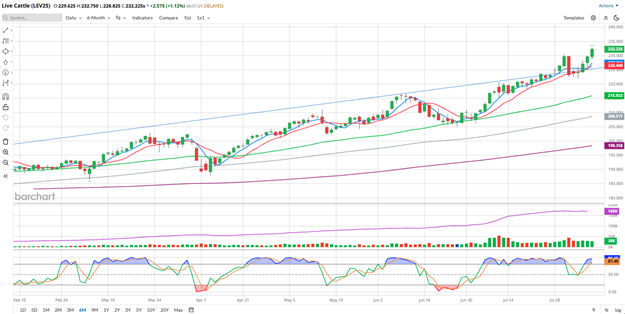

October Live Cattle (Daily)

October Live Cattle closed at 232.225 today, up 2.575 on the day. Today’s settlement was a new contract high for the October, following all of the other Cattle contracts which did that yesterday. Those other contract months also set new contract highs and closes today, as well. This market remains strong and is currently showing no real signs of slowing down that I see. I know that a number of people are concerned (and convinced) that a market top is imminent. They may end up being correct, but at the moment, I don’t see that happening. Many market participants and cattle producers recall the abrupt bearish turn that Cattle prices made in 2014, sparking a 2-year downtrend. But when I factor supply, demand and inflation into the mix, I keep finding bullish reasons. In the most recent reports from the USDA, the July Inventory and the July Cattle on Feed specifically, they show that we have significantly less cattle here in the US. The total inventory posted at 94.2 million head, the lowest ever, and the number on feed posted at 11.1 million head, a 2% decline from last year. Demand, I think, has increased from a simple population view. The US population at the beginning of 2015 was near 320 million and estimates put the current numbers near 342 million. So we’ve got less cattle and more people to potentially feed. The high that I see from November 2014 was 172.75. When that price is adjusted for inflation, a little over 36% cumulatively, that projects to about 236.000. I’m of the opinion that despite this large and consistent rally, all cattle prices have been doing is barely keeping up with inflation. And the inflation calculators that I used haven’t updated with July data yet. I know that the August contract closed above that level yesterday and today, but that contract price just got there now…er…yesterday. Add in the vanishing replacement cattle from Mexico due to screwworm, tariffs on Brazilian beef imports and I think all factors point toward higher prices.

From a technical point of view, I think the market is still bullish. Looking at the chart above, you might notice that the 5- and 10-day moving averages (blue/red) have been good support since mid-June. The 50- and 100-day averages (green/grey) are well below the market, currently, but have also acted as strong support the few times they’ve been interacted with. Stochastics (bottom sub-graph) popped into overbought territory with yesterday’s trade. You may notice that this market has spent more time over the last six months being overbought than oversold, and usually stays that way for an extended period. The blue trendline on there is drawn off of the January-June highs. That previously served as resistance, but now I think that’s become support, near roughly 225.000.

When I wrote about Live Cattle last week in this space, I advocated for long futures positions for the aggressive and well-margined traders and long call options for the less aggressive. If you chose to take either (or both) of those, the results have been mixed. You likely entered and got stopped out of the futures trade on Thursday of last week on that big, profit-taking selloff at the end of the month. The call options should be working in your favor. They haven’t yet hit the 2x target but they’re awfully close and I think it’s likely those orders will get filled tomorrow, assuming prices remain strong. This week, I would advocate for very similar positions. Aggressive and well-margined traders may do well to consider establishing long futures positions. Perhaps look for an entry point near the high from last week, around 230.425. I would recommend a sell-stop to protect your position, but given the higher volatility and larger price moves, I’ll leave that up to you. Maybe the weekly Puts that expire in 29 days, instead of the regular October options that expire in 57 days, would be a good choice to spend less on premium, although you should pay close attention to the option delta when selecting those. Less aggressive traders may do well to consider the October Call options. The October 242 calls settled at 3.125 today, or $1,250 before commissions/fees. Whichever strike you choose, place a GTC order to exit the long calls at 2x what you paid for them.

Call me directly, if you need additional suggestions.

If you like what you’ve read here and would like to see more like this from Walsh Trading, please Click here and sign up for our daily futures market email.

Every morning, at about 8 AM CST, I post a short video highlighting where I see opportunities in the futures markets. You can view my most recent video here

October Live Cattle (Weekly)

If you like what you’ve read here and would like to see more like this from Walsh Trading, please Click here and sign up for our daily futures market email.

Every morning, at about 8 AM CST, I post a short video highlighting where I see opportunities in the futures markets. You can view my most recent video here

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.