Expanded trading limits Monday for cattle complex

Howdy market watchers!

Twenty years ago Friday, I started my first full-time job at Rabobank in Hong Kong! It’s been a journey with plenty of adventure and mistakes that I have learned and grown from especially these last 10 years being a pioneering entrepreneur and commodity trader in rural Oklahoma. Much more pioneering ahead with a better-informed perspective.

Well, the heat is on! This week’s triple digit highs and dry winds remind us just how treacherous the month of August can be for crops and final summer outdoor plans. Back-to-school is here for some and right around the corner for others, but the sticker shock is here for all. Yes, headline inflation has continued to make progress to the Fed’s 2.0 percent target, but when you’re buying retail products and grocery items, it sure doesn’t feel like it.

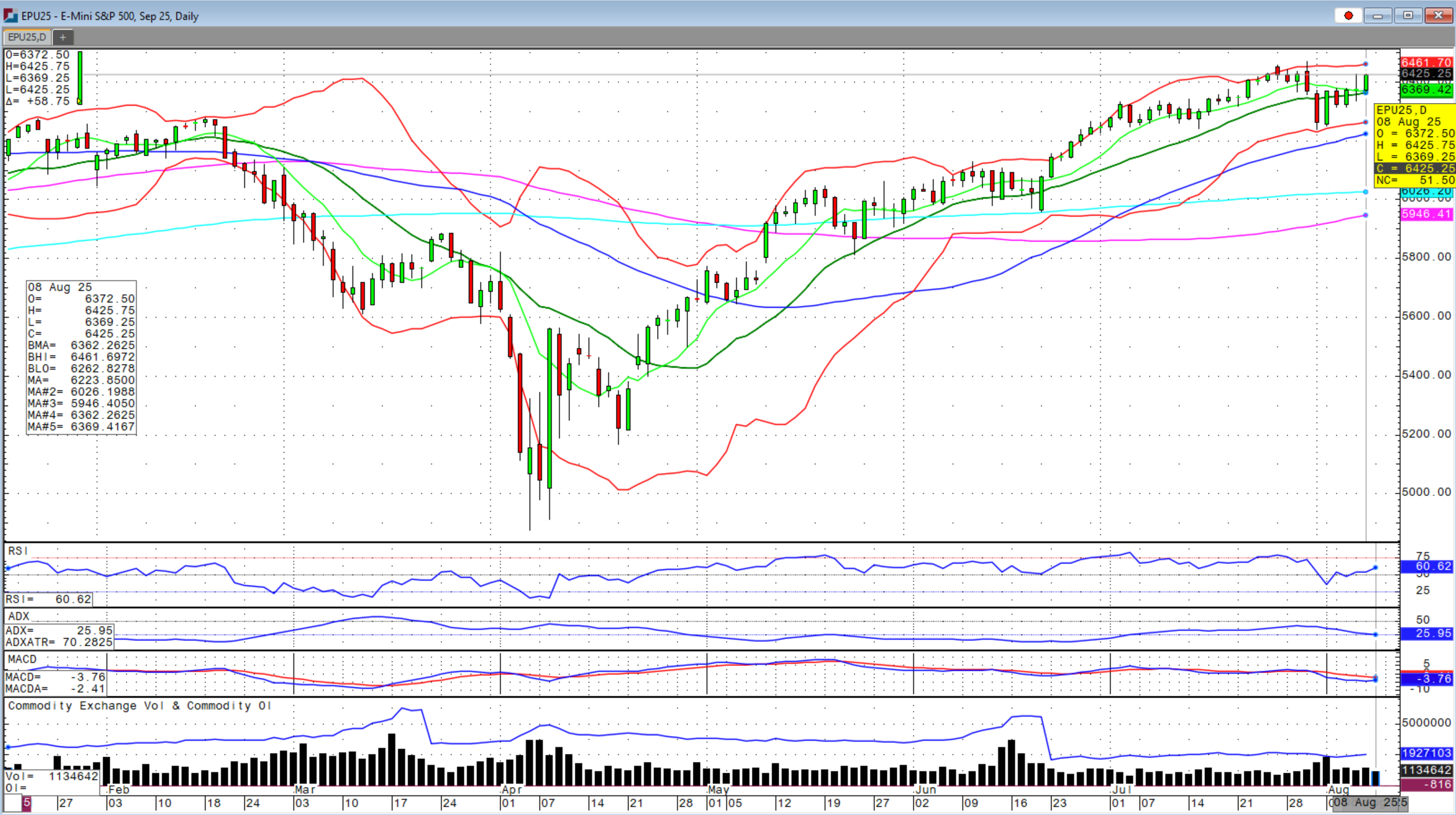

August is often a reality check month that can translate to market volatility. We had a touch of that last week in equities, and you’ll recall the major selloff last August, but so far, any such correction this year has been minimal to start the month. Despite continued threats of tariffs including the hike on August 7th on countries yet to make a deal with Trump, the market maintains strength.

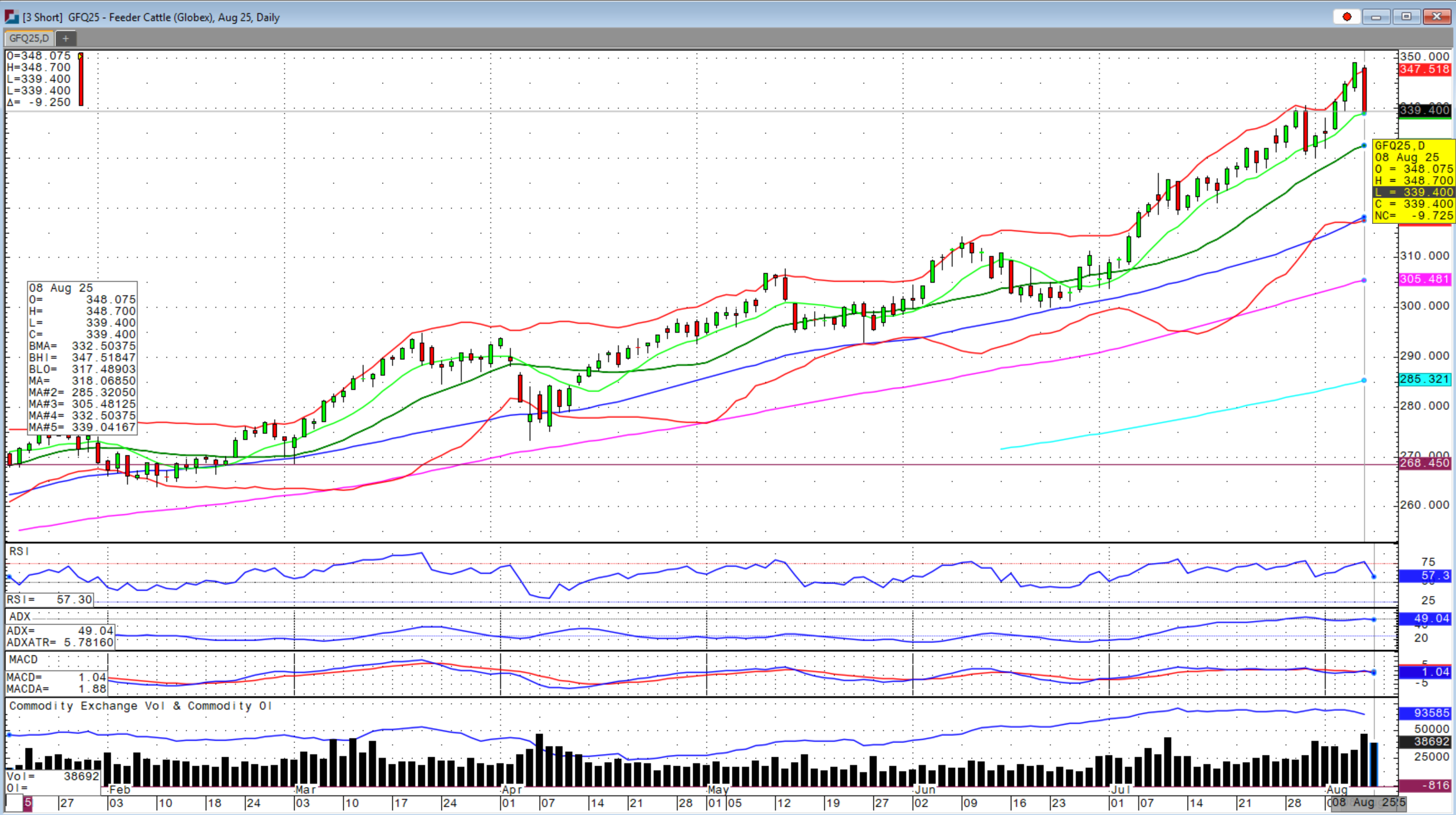

The cattle market has followed this euphoric trend with even fewer dips. Since the feeder futures passed $3.00, then $3.20, we’ve been calling for $3.50 and Thursday that became reality on September feeder cattle futures! In fact, September closed at the session high of $3.50200 per pound! Then came Friday. Rumors of screw worm detection in the US combined with packers reducing slaughter to 4 days per week, plunged feeder and fed cattle futures lower. All feeder contracts closed the session limit down, or $9.25 lower! August fed cattle futures also finished limit down. This means that expanded limits for feeders and fed cattle futures will be in place for Monday at $13.75 and $10.75, respectively. Get ready! We are likely to see more information over the weekend confirming or denying, more likely, the rumors about a US screw worm detection.

LRP was available Friday for fed cattle given only one month was limit down, but no LRP was available for feeder cattle given multiple months were limit down. None of the contracts made new highs on Friday, but made new lows with most touching down on the 9-day moving average where the limits allowed. Next stop for all the contracts is likely the 20-day moving averages, which would still be above the early August lows, meaning that the bull channel remains intact even after such a correction. A further selloff below those early August lows could suggest more of a technical breakdown. Monday’s action will be important to see if this is just another head fake before new highs, which is not out of the question.

Having said that, I do believe we are close to the highs if not already made them. Corporate earnings are starting to show signs of weakness and any material correction in the stock market could spill over into fund liquidation in the cattle complex. Suffice it to say, if you’ve done nothing to protect these cattle prices, I would advise doing so here even if markets move higher. Ultimately, when the top is in, finding the bottom will be like catching a falling knife. When that time comes, the psychology will be that you will wait until it shows real signs of corrections and then make a move, but at that point, we will be $30+ off the top. However, talking risk management in this market has been a monologue, but take notice as I believe the time is nigh. Call Sidwell Strategies for futures, options or LRP.

Alternatively, the grain complex has had a difficult time sparking bullish interest. Finally, the US dollar selloff has resumed helping draw international interest in US origin grains. And that is exactly what happened this week with phenomenal grain sales again this week. While old crop corn sales were lower than expected, new crop corn sales were huge and above even the highest pre-report estimate. Soybean sales for both old crop and new crop were higher than expected as were wheat sales. Such strength could lead to export demand adjustments in next Tuesday’s USDA WASDE and Crop Production reports.

Increased demand is indeed what is needed with large and growing crops expected in next week’s reports. StoneX came out with a shocking corn yield forecast of 188.0 bushels per acre (bpa) versus average trade estimates of 184.3 bpa and the highest estimate of 189.0 bpa, which would put production at 16.4 billion bushels! USDA’s current estimate from July was 181.0 bpa. Average trade guesses for soybeans are 53.0 bpa versus last month’s USDA estimate at 52.5 bpa.

With managed funds holding a sizeable net short across the grain complex, expect meaningful volatility upon the release of the report at 11 AM CDT. This week, the December new crop corn contract dipped below $4.00, but managed to close the week above that important level. November new crop soybeans remain below the $10.00 level. I was hoping to see corn hold more of its early strength on Friday, but it was the week’s end after all.

US corn conditions held steady at 73 percent Good-to-Excellent (G/E) this week despite trade guesses for a one percent decline. US soybean conditions declined one percent from last week, but in line with expectations. The wheat market has been attempting to break higher after holding this week’s new lows above the $5.00 threshold. US winter wheat harvest is now 86 percent complete versus 88 percent expected, but largely in line with the average.

Spring wheat harvest has started, slowly, but conditions slipped one percent behind last week as well as expectations. This is the time of year that spring wheat as well as corn is needed to support the wheat complex. However, this is also the time of year that we see more selling coming into wheat as harvest progresses around the Northern Hemisphere, which seems to be increasing above earlier expectations in many areas. Given that and depending on what the USDA does with global production and ending stocks in Tuesday’s report, I don’t expect that much upside right now from the wheat market and so caution advised.

If you’re holding physical wheat and need to access the liquidity tied up with that inventory, just get with Sidwell Strategies and we can position you with call options or long futures to stay in the market, but for a small fraction of the dollars versus holding the physical bushels. If you’d like to better understand the numbers associated with that strategy, just give us a call as these higher interest rates make this strategy even more worthwhile.

It was just announced that President Trump is set to meet Russia’s Putin at the end of next week in Alaska in hopes of making a deal to cease the Russia war against Ukraine. It’s difficult to see how that could be bullish and so be aware although I don’t believe there is any war premium left in this wheat market.

On a final note, we held the $5.00 level on Chicago and KC wheat on this last low, but I still expect we could still see Chicago and then KC wheat below $5.00 yet this year, largely dependent on how the corn crop and the trade deal with India develops. For now, the India deal is in dire straights with additional 25 percent tariffs cast on them for buying Russian oil and not making a trade deal, citing they’d rather pay higher tariffs than sacrifice their farmers, a key socio-economic struggle for many developing countries. Tariff strategies are here to stay and likely to continue for many months as the Trump Administration’s carrot and stick.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.