CPI Fizzles while the Northeast sizzles

CPI Fizzles while the Northeast sizzles

By John Thorpe, Senior Broker

The Consumer Price Index (CPI) was released today, offering another snapshot of inflation’s trajectory. With a year-over-year reading of 2.7%, slightly below expectations of 2.8%, the data suggests that inflationary spikes may be fading into the rearview mirror. That modest surprise was enough to fuel a rally in equities, pushing the Nasdaq 100 Index to new all-time highs at 23,930.00. The S&P 500, while strong, fell just shy of its July 31st peak—trading at 6,465.00 as of this writing, with a few hours left in the session.

Meanwhile, the Copernicus Data Space Ecosystem reported that this summer’s humidity index east of the Rockies, calculated using morning dewpoints, has reached record levels since data collection began. In stark contrast, Weather West noted that May through mid-July 2025 has been among the coldest starts to summer in 30–40 years for parts of the Bay Area, with persistent marine layers, chilly winds, and cloud cover dominating the season. These weather anomalies have real implications for agriculture, particularly crop development and yield potential.

Today’s World Agricultural Supply and Demand Estimates (WASDE) confirmed a record-setting corn crop, with average yields forecast at 188.8 bushels per acre, up 9.5 bushels from last year. States like Idaho, Illinois, Indiana, Iowa, Minnesota, Missouri, South Carolina, South Dakota, Tennessee, Virginia, and Wisconsin are all expected to hit record highs. As of August 3, 73% of the corn crop was rated in good or excellent condition, 6 points above last year’s benchmark.

Soybeans are also on track for a banner year, with yields projected at 53.6 bushels per acre, up 2.9 bushels from 2024. If realized, record yields are expected in Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Michigan, Minnesota, Mississippi, Missouri, North Carolina, and Virginia.

At Cannon Trading, we actively trade these markets—often deploying seasonal bull or bear spreads that capitalize on price relationships between front-month (old crop) and deferred-month (new crop) contracts. These strategies can offer lower initial margin requirements and help manage risk during volatile seasonal transitions. We’ve created a Seasonal Spread Cheat Sheet PDF for traders interested in exploring these setups.

📄 Click here for the Seasonal Spread Cheat Sheet!

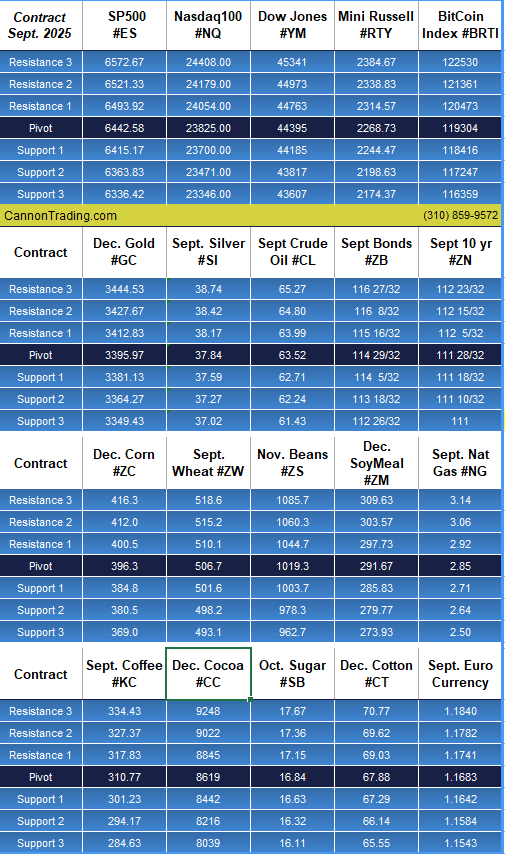

Trading Levels for Aug. 13th:

Reports for Aug. 13th:

Good Trading!

Ilan Levy-Mayer, M.B.A

Vice President

Cannon Trading Co, Inc. Est. 1988

www.CannonTrading.com

Toll Free: 800-454-9572

Int'l: +310-859-9572

Margins / Commissions / Platforms / Professional Traders /Free Demo

Trading commodity futures and options involves a substantial risk of loss.

The information here is of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future results.