Soybean ending stocks estimates lower than expected

I am Stephen Davis, senior market strategist at Walsh Trading Inc. in Chicago, Illinois. 312-878-2391.

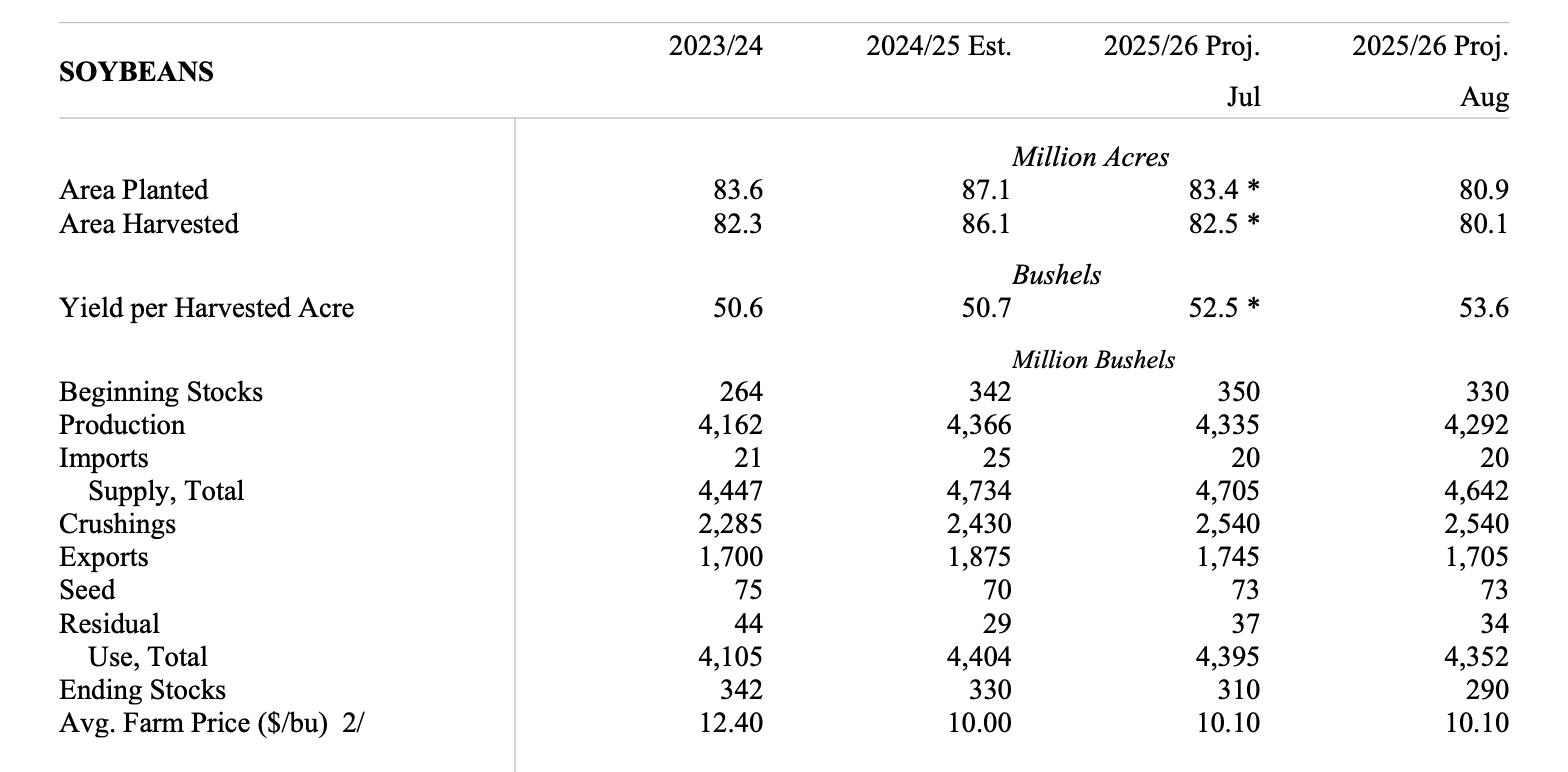

Soybean figures stand out in the U.S. Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates report released today, August 12. Ending stocks for 2025-2026 projections came in at 290 million bushels, down from 310 million in July.

Soybean ending stocks are the amount of soybeans remaining at the end of the marketing year (typically September 1 to August 31) after all uses such as domestic crush, exports, seed and residual are accounted for. These stocks are a key indicator of supply and demand in the soybean market, influencing prices and future production decisions.

Source: USDA World Agriculture Supply and Demand Estimates report, August 12, 2025.

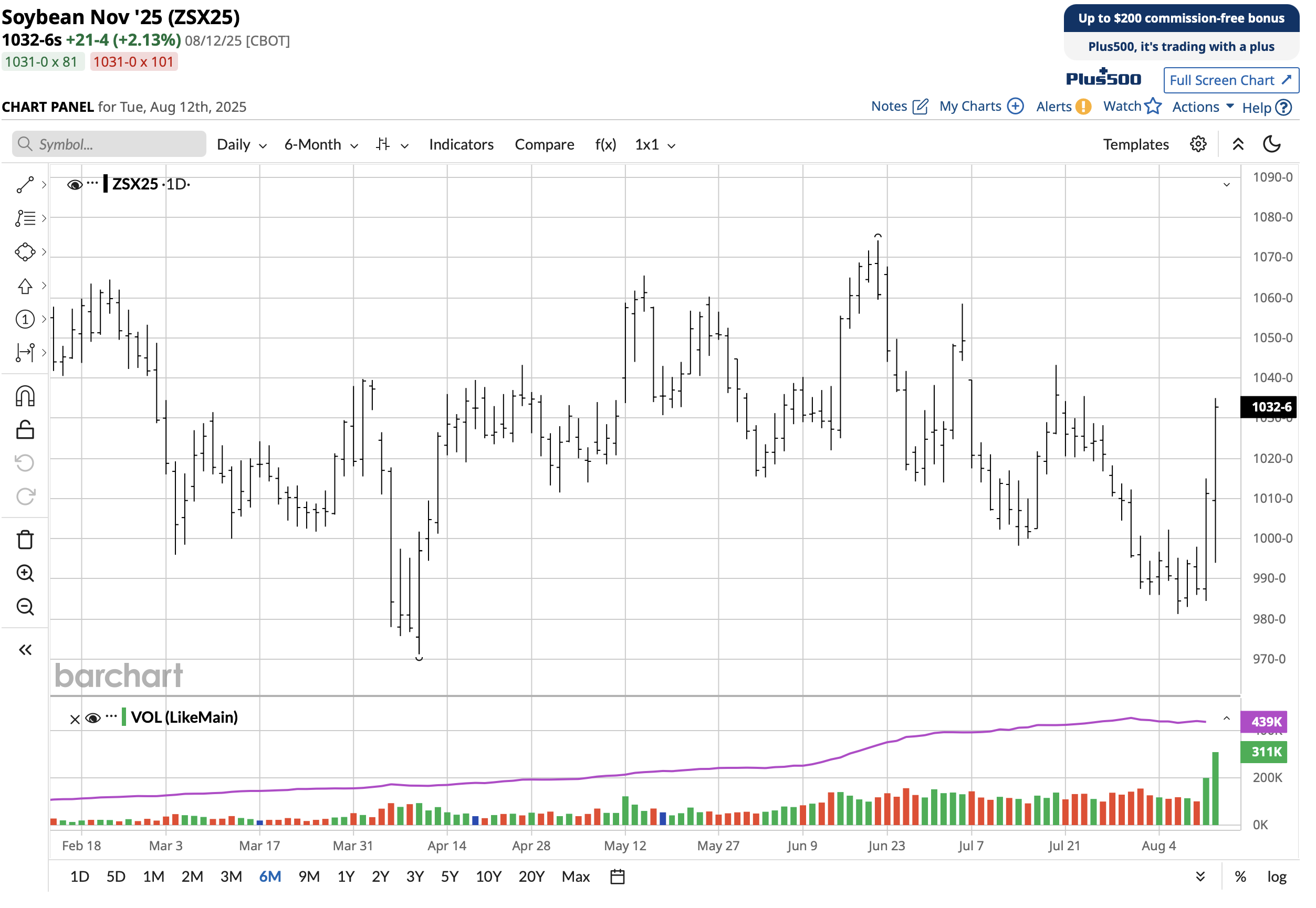

I show you a daily chart and a four-hour chart below.

The daily chart shows a reversal up yesterday so tomorrow would be day three of higher highs and higher lows. Look for strength in soybeans continuing into Wednesday's trading session.

Below is a four-hour chart on November soybeans. I like four-hour charts on all markets because they show trends and momentum in the short term.

If President Trump makes a deal to sell U.S. soybeans to China, prices can change quickly. Today's report is bullish, in my opinion, due to lower ending stocks than expected.

Trade strategy is to sell three September soybean, $10 puts at 7.4 ($375). With that premium in your account, buy one November 1040 call at 24 ($1,200). The options you are selling expire August 22. Ten days from now any rally in soybeans and time decay is going to work and those options can expire worthless, in my opinion. The November call expires October 24.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878 2391

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.