Walsh Pure Supply & Demand - Pure Hedge Division

The August WASDE report was released Tuesday morning by the USDA. December corn made a low on Tuesday at $3.92. Today, December corn closed +2 1/4 cents higher at $3.96 3/4, while September corn closed +1 1/4 cents higher at $3.72 3/4. December corn has support at $3.86 3/4, $3.85, and $3.81 1/2; resistance is at $4.00, $4.02 1/4, and $4.12 3/4.

New Crop

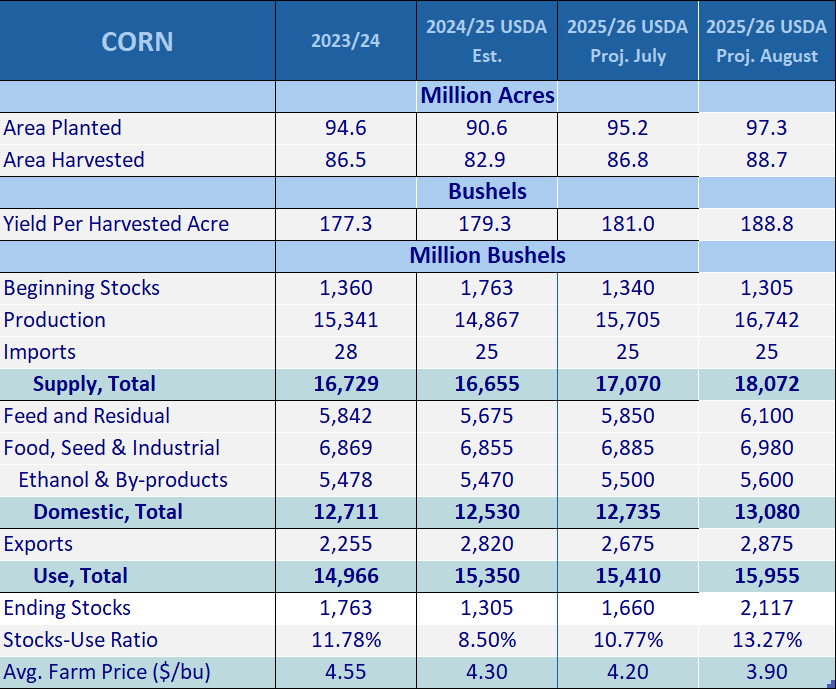

The USDA increased planted acres from 95.2 million acres (ma) in July to 97.3 ma. Harvested acres are estimated at 88.7 ma from 86.8 ma previously. The big change on this report was the increase in the yield estimate from 181 bushels per acre (bpa) to 188.8 bpa. The USDA came in above the high end of yield estimates at 188.1. The average yield estimate was 184.4 bpa, and the lowest was 182.5 bpa. Weather has been favorable all season long, which has prevented any weather premium from being added to the market. Some wet areas could bring yield down going forward, however. Production is now estimated at 16,742 billion bushels (bb), compared to 15,341 bb in 2023/24 and 15,705 bb last month. The USDA made increases to demand, most notably, increasing feed and residual usage 250 million bushels (mb) to 6,100 mb and ethanol 100 mb to 5,600 mb. Exports were also raised to 200 mb to 2,875 mb versus 2,675 in July. If not for the higher adjustments made to feed use, ethanol, and exports ending stocks would be even more bearish. Exports will need to be huge to offset all the supply. Ending stocks are now 2,117 bb, with a stocks/use of 13.2%.

World ending stocks were 282.54 million tons (mt), compared to 277.8 mt in July. The trade estimate range was 272.6-285 mt. Argentina’s corn production for 2024/25 was 50 mt, falling within the expected range of 49-51 mt. Brazil’s corn production for 2024/25 was 132 mt, with analyst estimates between 132-139.4 mt.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

Old Crop

Looking at old crop, the USDA made some adjustments to demand compared to the July figures. Food, seed, and industrial usage was lowered by 35 mb to 6,855 mb. Ethanol was lowered from 5,500 mb in July to 5,470 mb, and old crop exports were increased by 70 mb to 2,820 mb, bringing old crop ending stocks to 1,305, a reduction of 35 mb from July 11.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

COT

For the week ending August 5, managed money traders bought +7,435 contracts bringing their net short position to -173,750 contracts. For the week ending July 1, the funds were short -206,463 contracts.

Corn could see a move lower from here, but downside is likely limited because the market had already priced in a bearish yield ahead of the August WASDE. Trade deals with Mexico, India, and China have yet to be signed. Looking at the USDA’s past adjustments, they have a historical tendency to report a lower final yield then the August WASDE. If you think the corn market has reached peak supply fear and is close to putting in a bottom, consider the following trade idea:

TRADE IDEA

DECEMBER CORN

Sell 2 December’25 400 Puts 27 1/2 credit

Buy 1 December’25 425 Call 5.37 1/2 debit

Price: 22.125 cents CREDIT

Cost: $1,106.25 CREDIT/Trade Package, Plus Fees and Commissions

December’25 Corn Options Expire 11/21/25 (100 Days)

This trade costs you nothing to put on. You actually receive $1,106.25 per Trade Package when you put it on. If December corn hits 384 or lower buy back the entire spread, capping downside at approximately $493.75 per spread. The low for the year on December corn is 385.

Profit = 57 1/8 cents or $2,856.25/Trade Package with corn at $4.60 at expiration,

Profit = 77 1/8 cents or $3,856.25/Trade Package with corn at $4.80 at expiration,

Profit = 97 1/8 cents or $4,856.25/Trade Package with corn at $5.00 at expiration

ALL PRICES ARE FRIDAY’S SETTLEMENT – DEC ’25 CORN CLOSED @ 396 3/4

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

If you’re ready to start trading, click the link below to open an account with Walsh Trading, Inc.

Hans Schmit, Walsh Trading

Direct 312-765-7311 Toll Free 800-993-5449

hschmit@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.