O’Reilly Automotive Stock: Analyst Estimates & Ratings

/O'Reilly%20Automotive%2C%20Inc_%20logo%20and%20data%20by-%20Piotr%20Swat%20via%20Shutterstock.jpg)

O’Reilly Automotive, Inc. (ORLY), widely recognized as O’Reilly Auto Parts, is a major supplier in the automotive aftermarket industry. Headquartered in Springfield, Missouri, the company was founded in 1957 and has since expanded to operate over 6,400 stores across the United States, Puerto Rico, Mexico, and Canada.

With a market capitalization of $86.95 billion, the company offers a wide range of auto parts, tools, accessories, and maintenance supplies, catering to both professional technicians and individual car owners. O’Reilly supports its retail operations with an efficient distribution system and offers services such as battery testing, tool rentals, and fluid recycling, all designed to deliver reliable and customer-friendly automotive solutions.

O’Reilly’s stock has had a stable time on Wall Street. Over the past 52 weeks, the company’s shares have gained 38.2% and they are up by 30.5% year-to-date (YTD). The stock has broadly outperformed the S&P 500 Index ($SPX), which has gained 15.1% and 9.9% over the same periods, respectively.

The company is categorically placed under the consumer cyclical sector due to the discretionary nature of its business. The Consumer Discretionary Select Sector SPDR Fund (XLY) has gained 25.4% over the past 52 weeks and 4.2% YTD. Therefore, O’Reilly has been an outperformer in its sector as well.

On July 23, O’Reilly reported solid second-quarter results for fiscal 2025. Its sales climbed by 5.9% year-over-year (YOY) to $4.53 billion. The sales figure aligned with the consensus estimate from Wall Street analysts. Its comparable store sales increased by 4.1%, driven by solid growth in both professional and DIY businesses. Its EPS increased by 11.4% YOY to $0.78, marginally higher than the $0.77 that Wall Street analysts were expecting.

Just a day after, on July 24, the stock gained 2.9% intraday. The stock had reached a 52-week high of $104.86 on Aug. 7, and is only down 1.6% from this high. This year, the company enacted a 15-for-1 stock split to make its stock more accessible.

For the fiscal year 2025, ending in December 2025, Wall Street analysts expect O’Reilly’s EPS to grow 7.7% YOY to $2.95 on a diluted basis, and increase by 12.2% to $3.31 in fiscal 2026. The company has a mixed history of surpassing consensus estimates, topping them in two of the trailing four quarters and missing them on two other occasions.

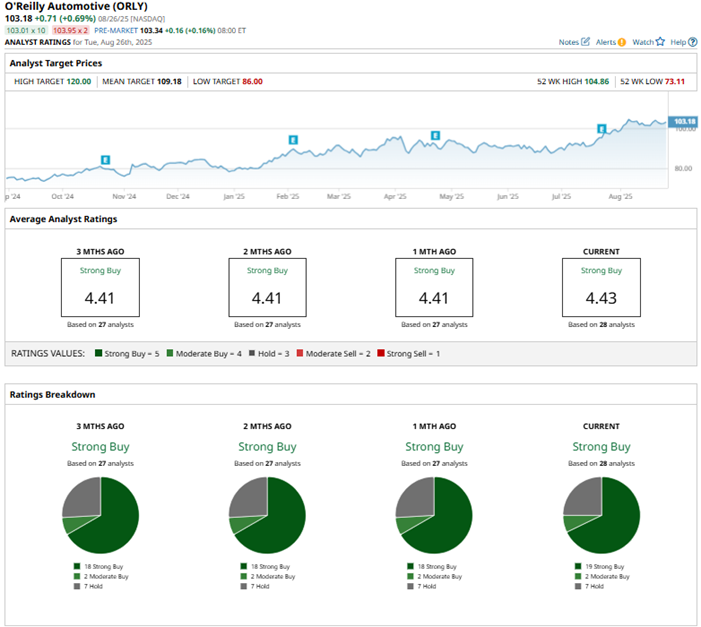

Among the 28 Wall Street analysts covering O’Reilly’s stock, the consensus is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and seven “Hold” ratings.

The configuration of the ratings is more bullish than it was a month ago, with 19 “Strong Buy” ratings now, instead of the previous 18.

This month, analysts at Evercore ISI maintained O’Reilly’s stock rating at “Outperform,” while raising the price target from $108 to $110, indicating bullish sentiments.

O’Reilly’s mean price target of $109.18 indicates a 5.8% upside over current market prices. The Street-high price target of $120 implies a potential upside of 16.3%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.