DXY Is Still Bearish; Final Leg Of The Wedge Pattern?

US Dollar Index – DXY made only a three-wave rise from the lows, which indicates for a correction within downtrend. So recovery can basically still be a fourth wave rally, just a bit deeper one that can still belong to an ending diagonal a.k.a. wedge pattern. Final wave “v” of 5 can be still missing, so be aware of a continuation lower within a new three-wave abc decline, especially if breaks below the lower side of the corrective channel near 97.70 level.

www.wavetraders.com

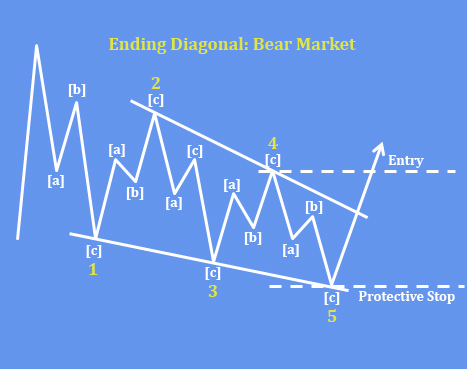

Ending Diagonal Wedge is a chart pattern that appears at the final stages of a trend, signaling a potential reversal. The pattern is defined by converging trendlines, where both support and resistance lines slope in the same direction, often upward or downward. The pattern consists of five overlapping waves (1-2-3-4-5), each subdividing into a 3-wave structure (a 3-3-3-3-3 formation). A key feature is decreasing momentum, as price action becomes increasingly narrow and choppy, reflecting weakening buying or selling pressure.

www.wavetraders.com